Response to Climate Change

Climate change-related information disclosure

As an endorser of the recommendations of TCFD, we have been disclosing information as per the international climate change-related disclosure framework, and we have also responded to the CDP* since 2022.

As we enhanced our initiatives for coping with climate change, the score of CDP improved from C in FY 2022 to B- in FY 2023.

*CDP is an international non-governmental organization headquartered in London and collects and analyzes information on the environmental activities of the world's major corporations and rates corporate initiatives on an eight-point scale of A, A-, B, B-, C, C-, D, and D-. The Group has responded to the Climate Change Questionnaire since 2022 and the Water Security Questionnaire in addition to the Climate Change Questionnaire since 2023.

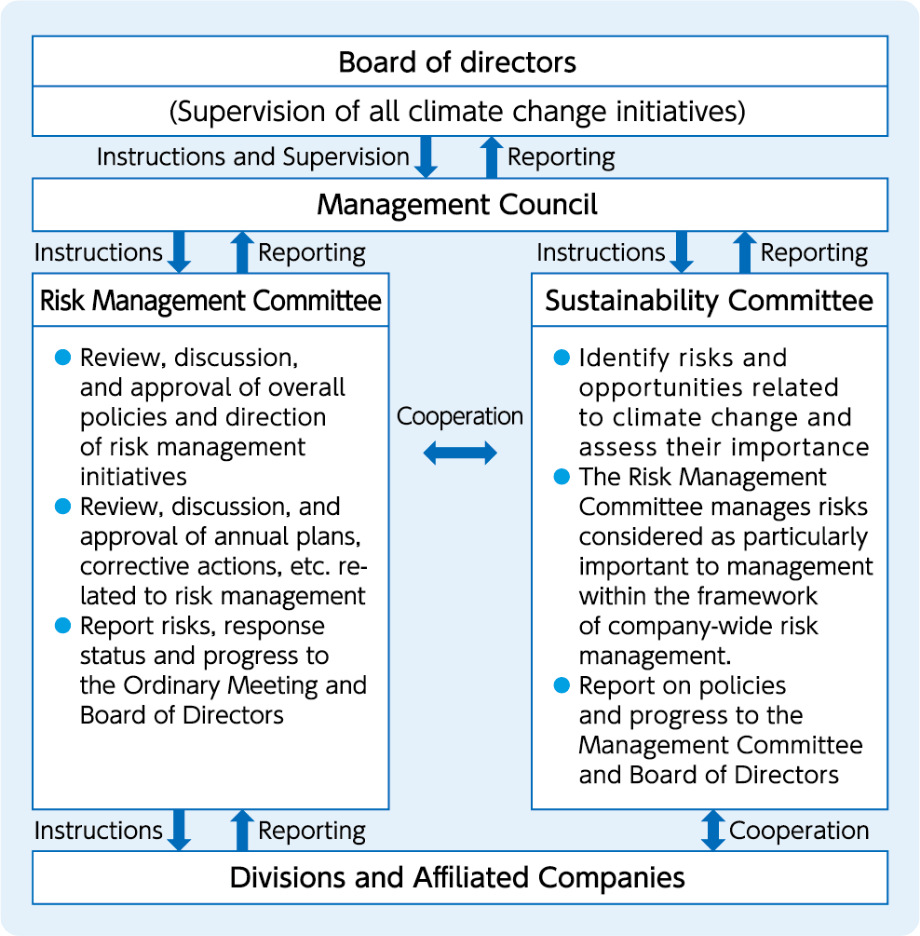

Governance structure

The Company's Board of Directors recognizes that addressing climate change is one of the most important management issues and makes decisions on important measures not only from the perspective of risk management, but also from the perspective of business creation and supervises the execution of such measures.

We will establish management indicators and targets (see "Metrics and targets") to measure progress on key issues and monitor progress under a promotion system centered on the Sustainability Committee, a permanent committee that promotes sustainability-related activities, including addressing climate change issues, on a company-wide, ongoing basis, with the director and president as the general leader.

In addition, we have established a system under which our Board of Directors receives regular reports from the Committee on the status of the Group's sustainability initiatives, including its response to climate change issues.

Strategy (scenario analysis)

Our group have analyzed the impact of climate change on each business in 2030 under two scenarios: a scenario in which we aim to achieve economic growth while keeping the global average temperature increase below 1.5°C in 2100 compared to pre-industrial times ("1.5°C Scenario")*1 and a scenario in which we aim to achieve economic growth using fossil fuel as the main source of energy based on the current state and the global average temperature will increase 4.0°C in 2100 compared to pre-industrial times ("4°C Scenario")*2.

In the 1.5°C scenario, transition risks include the augmentation of material and energy costs due to the introduction of a carbon tax, resulting in the decline in demand for less energy-efficient equipment and demand from fossil resource-related industries and products for equipment using fossil fuel. On the other hand, demand for products and technologies that meet the decarbonization needs is expected to increase further. Our group has a proven track record in designing, manufacturing, and constructing equipment and facilities that address social issues, mainly in the environmental field, including water and air pollution control. We believe that these elemental technologies are our strengths that can be applied to products and technologies related to hydrogen and the cultivation and utilization of algae in response to decarbonization, and we believe that there are ample business opportunities in this area.

In the 4°C scenario, we believe there will be opportunities to provide our group's existing products and technologies to meet the needs for resilient equipment and facilities to cope with the risk of severe natural disasters caused by climate change. However, we believe that the physical risk of flooding, sea level rise, and other factors affecting supply chains, such as suppliers and transportation networks, process delays, and reduced work efficiency due to higher average temperatures will be greater.

*1 IEA NET Zero by 2050-A Roadmap for the Global Energy Sector, IPCC Sixth Report SSP1-1.9 climate impact Information disclosed by the Ministry of the Environment and the Japan Meteorological Agency.

*2 IPCC Sixth Report SSP5-8.5 scenario, information disclosed by the Ministry of the Environment and Japan Meteorological Agency.

Risks posed by climate change

Transition Risk

| Classification | Item | Content | Impact*3 | Evaluation axis*4 | Our response |

|---|---|---|---|---|---|

| Policies/ Legal Regulations |

Introduction and strengthening of taxes and regulations related to CO2 emission reduction*5 | Introduction ofcarbon tax (materials) | Large | Medium to long-term |

|

| Increased electricity costs due to the spread of renewable energy sources | Medium | Medium to long-term | |||

| Products and services |

Changes in social demands | Decrease in demand for energy-inefficient facilities | Small | Short to medium-term | Continuing to develop and sell energy-efficient products |

| Decrease in demand for fossil fuel-related facilities | Large | Short to medium-term | Promote development and sales of CCUS equipment | ||

| Decrease in demand for stand-alone machinery, mainly oil purifiers and parts | Large | Short to medium-term | Promote development of new applications for solid-liquid separation technology for renewable energy, etc. |

Physical Risk

| Classification | Item | Content | Impact*3 | Evaluation axis*4 | Our response |

|---|---|---|---|---|---|

| Acute | Severe wind and flood damage | Process delays and supply chain disruptions due to severe natural disasters | Small | Medium to long-term |

|

| Chronic | Climate change | Rising average temperatures will reduce work efficiency in plant construction and equipment manufacturing | Small | Medium to long-term | |

| Rising sea levels and long-term changes in rainfall patterns (heavy rains and droughts) will increase business continuity risks for our business sites and business partners and result in disaster prevention and suitable location relocation costs | Small | Short to medium-term |

*3 [Evaluation of impact] Large: Sales of 5 billion yen or more Medium: Sales of 1 billion to less than 5 billion yen Small: Sales of less than 1 billion yen

*4 [Time axis evaluation] Long-term: Impact by 2050 Medium-term: Impact by 2030 Short-term: Impact by 2025

*5 Assuming that profit margin is 10%, the impact of the increase in the procurement cost of materials and electricity (decreased profit) is evaluated by using the equation:Impact amount ÷ 10% = Sales amount.

*6 Engineering & Manufacturing

Opportunities presented by climate change

Transition opportunity

| Classification | Item | Content | Impact*3 | Evaluation axis*4 | Our response |

|---|---|---|---|---|---|

| Products and services |

Changes in social demands | Increased demand for resilient/energy-saving plants and equipment | Medium | Medium to long-term |

【Strategic Business Domain】 Business initiatives to develop next-generation technologies to solve issues such as water and food problems and natural disasters

|

| Increased demand for biogas |

Medium |

Short to long-term |

【Strategic Business Domain】 Initiatives to promote a sound material-cycle society business that is sustainable

|

||

|

【Strategic Business Domain】 Clean Energy Business Initiatives with Hydrogen at its Core

|

*3 [Evaluation of impact] Large: Sales of 5 billion yen or more Medium: Sales of 1 billion to less than 5 billion yen Small: Sales of less than 1 billion yen

*4 [Time axis evaluation] Long-term: Impact by 2050 Medium-term: Impact by 2030 Short-term: Impact by 2025

Risk management

With regard to the management of risks related to climate change, we cooperate with the existing "Risk Management Committee" as shown in the chart in the section about governance structure. Regarding the division of roles, the "Sustainability Committee," which is a standing committee, is in charge of extracting and identifying risks, while the "Risk Management Committee" determines and manages the progress of policies for addressing these risks.

While declaring that risks related to climate change are considered subject to risk management of all group companies, the "Risk Management Committee" manages risks deemed important by the "Sustainability Committee" as important risks concerning all companies and regularly reports on how these risks are addressed to the Board of Directors.

Through these activities, we extract and evaluate short-, medium- and long-term risks concerning all companies and discuss countermeasures, and the Board of Directors supervise them.

Metrics and targets

We will calculate and grasp the greenhouse gas (GHG) emissions in our value chain, set two targets and forge ahead with initiatives as a step toward the realization of a carbon-neutral society.

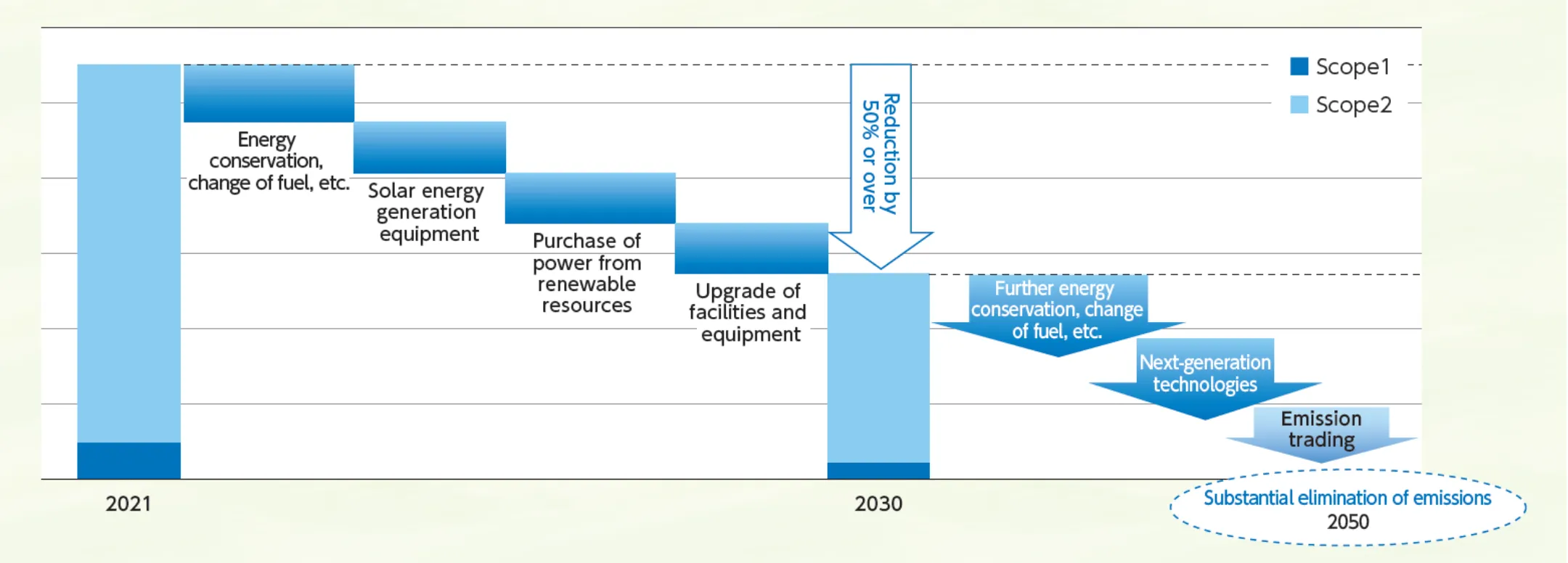

1 To achieve net zero GHG emissions in our corporate group (Scopes 1 and 2) by 2050

We will reduce GHG emissions from the plants and offices of our corporate group to virtually zero by 2050. As a step toward achieving this long-term target, we will strive to reduce GHG emissions by 50% or over in comparison with fiscal 2021 by 2030 by generating part of the power used at our major plants from renewable energy based on the solar energy PPA model, etc. in addition to concluding contracts for receiving power originating from renewable energy with a non-fossil fuel certificate.

2 To boost the growth of new business fields that would help solve social issues

Upholding the "Mitsubishi Kakoki Group's Management Vision for 2050," we have identified five social issues such as CO2 and climate change or resources recycling and set four strategic business fields as a step toward the realization of a comfortable society, endeavoring to achieve sustainable growth.

Three of these strategical business fields ‒(1) Business for realizing a sustainable recycling society, (2) Hydrogen-based clean energy business and (3) Business of saving labor and energy utilizing digital technology ‒ shall lead to the reduction of CO2 emissions in the whole value chain of our corporate group and we are forging ahead.

(1) is a business of recycling waste produced by industry and households, for example, by collecting biogas from organic waste, recycling plastic waste as part of valuable material recycling or collecting CO2 as part of carbon recycling. We will work toward developing this business by utilizing and improving our technologies such as solubilization technologies, biogas-related technologies and technologies for the separation of membranes, adsorbents, etc.

(2) is a business related to the generation, use and application of hydrogen-based clean energy that contributes to decreasing CO2 emissions, such as the production of green hydrogen and blue hydrogen, transport, storage and supply in the hydrogen supply chain and creation of energy originating from living organisms such as algae. We will work toward developing this business by utilizing and improving our technologies such as renewable energy generation technologies, hydrogen production technologies, high-efficiency hydrolysis technologies, hydrogen storage alloy technologies, and cultivation and extraction technologies.

(3) are E&M and O&M businesses that utilize digital technology to contribute to the minimization of energy consumption and waste at plants, and we will aim for demonstrating the function of our technologies, such as technologies for the automatization and increased efficiency of engineering, procurement and construction (EPC), 3D engineering and RPA, by utilizing and improving them cross-sectionally over the entire group. All group companies will work together with the newly established "Technology Development & Production Management Headquarters" and "Digital Transformation Department" at the center and strive to reinforce the foundations of the labor-saving and energy-saving business.

In addition to treating these businesses as our mainstay businesses, we will work toward the establishment of a new business portfolio and forge ahead with our initiatives in order to achieve sales of 100 billion yen coupled with the existing business fields by 2035.

Scope1+2 CO2 emissions (t-CO2) *

(Unit: ¥ million)

| FY2019 | FY2020 | FY2021 | FY2022 | FY2023 | |

|---|---|---|---|---|---|

| Scope1+2 CO2 emissions (t-CO2) | 2,691 | 2,494 | 2,716 | 2,536 | 726 |

* Figures from FY 2023 are those reflected a revision in the calculation method to reflect the effect of reducing CO2 emissions through the introduction of real renewable energy.

Roadmap for the reduction in Scopes 1 and 2

Environment initiatives

The Mitsubishi Kakoki Group has been contributing to the preservation of the environment by designing, manufacturing, and installing equipment for the improvement of the environment in the fields of prevention of water pollution, atmospheric pollution, etc. since the start of the chemical industry in Japan. Recognizing that environmental conservation is one of the most important issues facing mankind today, we will continue to work to reduce our environmental impact on a companywide basis while contributing to the realization of an economically sustainable society.

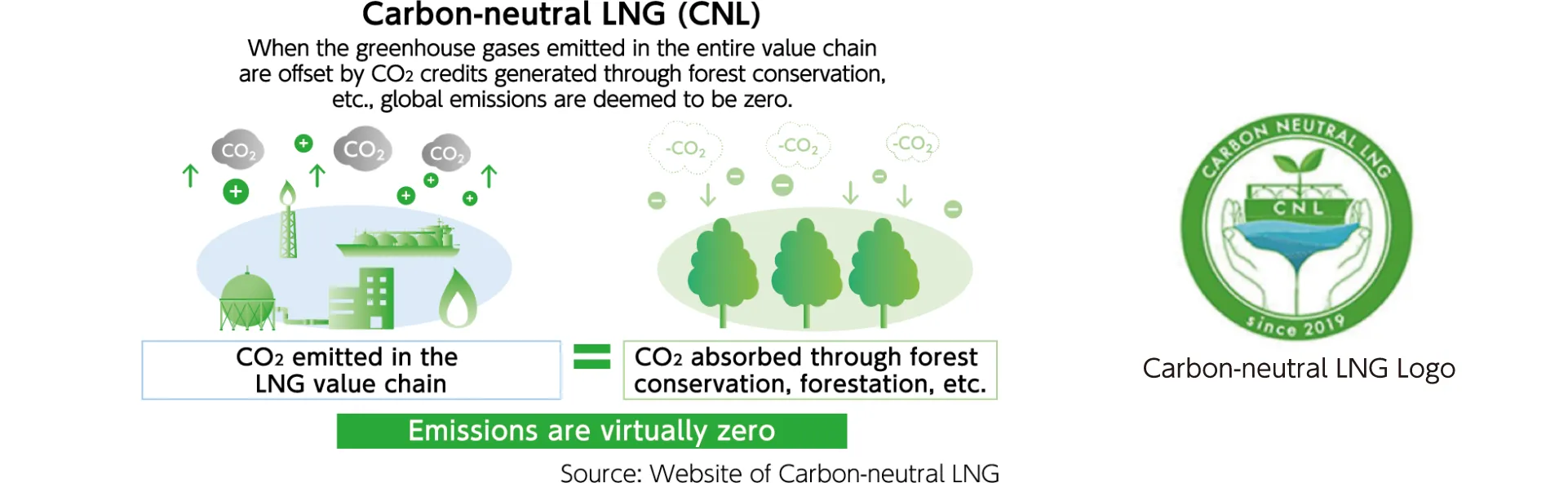

Adopted carbon-neutral city gas in Kawasaki Plant. This is the first in Wangan Area of Kawasaki City

We started using the carbon-neutral city gas (hereinafter called "CN City Gas") supplied by Tokyo Gas Co., Ltd. in Kawasaki Plant on February 1, 2022. This is the first adoption in Wangan Area of Kawasaki City. This is expected to contribute to the reduction of CO2 emissions in this area and decrease CO2 emissions in Kawasaki Plant of our company. We also joined "Carbon-neutral LNG Buyers' Alliance."

Through the adoption of CN City Gas, Kawasaki Plant can reduce CO2 emissions by about 475 tons/year or about 20%. Our group will conduct business activities to contribute to solving social issues about CO2, climate change, recycling of resources, etc. through manufacturing and engineering.

Source: Website of Carbon-neutral LNG

<Outline of Supply of CN City Gas>

- Supply site: Kawasaki Plant of Mitsubishi Kakoki Kaisha, Ltd. (2-1 Okawa-cho, Kawasaki-ku, Kawasaki-shi)

- Supply volume: about 166,000m3 /year

- Date of start of supply: Feb. 1, 2022

Adoption of electric power with a non-fossil certificate and installation of solar panels

Since May 2023, we have been using electric power with a non-fossil certificate at Kawasaki Works, Kashima Factory, and bachelors' dormitories for employees. In addition, we are improving the self-sufficiency rate of electric power by installing solar panels at SJ Factory of Kawasaki Works and Yokkaichi Business Office, and striving to realize zero-emission factories while restructuring the head office and Kawasaki Works.

Investment in environmental measures

We contribute to the realization of a sustainable society, by continuing the investment in SDG-related bonds. We have continued such investment since FY 2021, and we currently hold six kinds of bonds.

[FY 2021]

Term: 5 years, Total amount of issue: 10 billion yen, Interest rate: 0.001%

Term: 10 years, Total amount of issue: 5 billion yen, Interest rate: 0.269%

[FY 2022]

Term: 10 years, Total amount of issue: 10 billion yen, Interest rate: 0.379%

Term: 5 years, Total amount of issue: 11 billion yen, Interest rate: 0.2%

Term: 10 years, Total amount of issue: 9 billion yen, Interest rate: 0.76%

[FY 2023]

Term: 5 years, Total amount of issue: 10 billion yen, Interest rate: 0.438%

Registration in the certification system of each municipality

We are promoting registration in the SDG-related certification system of each municipality. At present, our company is registered as a gold partner (the most highly ranked) in Kawasaki City and a superior (the second most highly ranked) in Yokohama City.