For Individual

Investors

I, as a top executive, will make sincere efforts to

have our company "Growth and departure

from the status quo"

As the top management, I am sincerely committed to

our company's growth and de-emergence.

-

Amount of

orders received¥64.92

billion

-

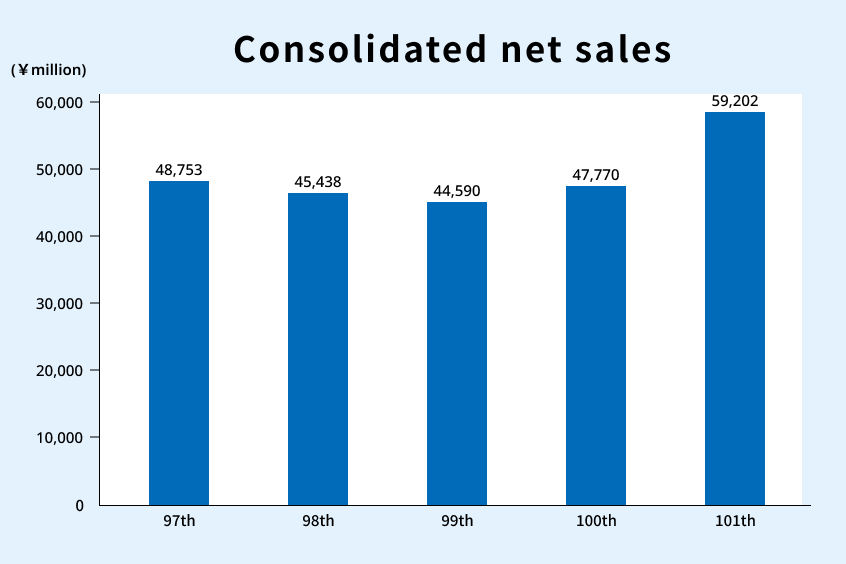

Sales

¥59.20

billion

-

Operating

income¥5.69

billion

-

Ordinary

income¥5.62

billion

-

Net income

¥4.87

billion

As of the end of March 2025.

Earnings forecast

Regarding the consolidated earnings forecast for the fiscal year ending March 2026, we project that sales will be 88.50 billion yen, operating income will be 9.00 billion yen, ordinary income will be 9.10 billion yen, and net income attributable to owners of parent will be 6.85 billion yen.

-

Amount of

orders received¥70.5billion

(plus 8.6%)

-

Sales

¥88.5billion

(plus 49.5%)

-

Operating

income¥9.00billion

(plus 58.0%)

-

Ordinary

income¥9.10billion

(plus 61.7%)

-

Net income

¥6.85billion

(plus 40.4%)

Note: As of October 31th, 2025. Percentage figures are year-on-year changes.

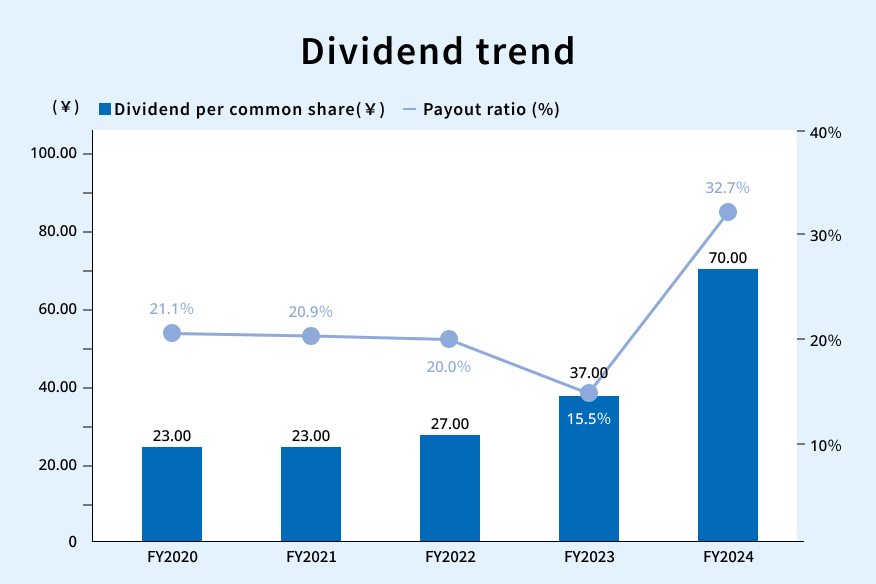

Shareholder return policy

While giving top priority to the return of profit to our shareholders, we allocate dividends based principally on the payment-by-results system while striving to stabilize the management base and boost retained earnings on a long-term basis. We save retained earnings as funds for preparing for future business expansion, such as enhancement of the financial structure, development of new products and technologies, and improvement and upgrading of production equipment.

-

Dividend

¥70/share

-

Payout ratio

32.7%

-

EPS

¥213.79

-

Market

capitalization¥30.93billion

As of the end of March 2025.

Mitsubishi Kakoki Group's

Management Vision for 2050

Challenging sustainable development

and creating a comfortable society

Amid the significant change in the business environment surrounding the Mitsubishi Kakoki Group, we established the "Mitsubishi Kakoki Group's Management Vision for 2050" in 2021 under the vision statement of "Endeavoring to realize sustainable development and realizing a comfortable society," in order to continue our sustainable growth.

We will endeavor to realize the vision by clarifying five social issues our corporate group should solve, pursuing four strategic business domains, and establishing a new business portfolio for addressing social issues.

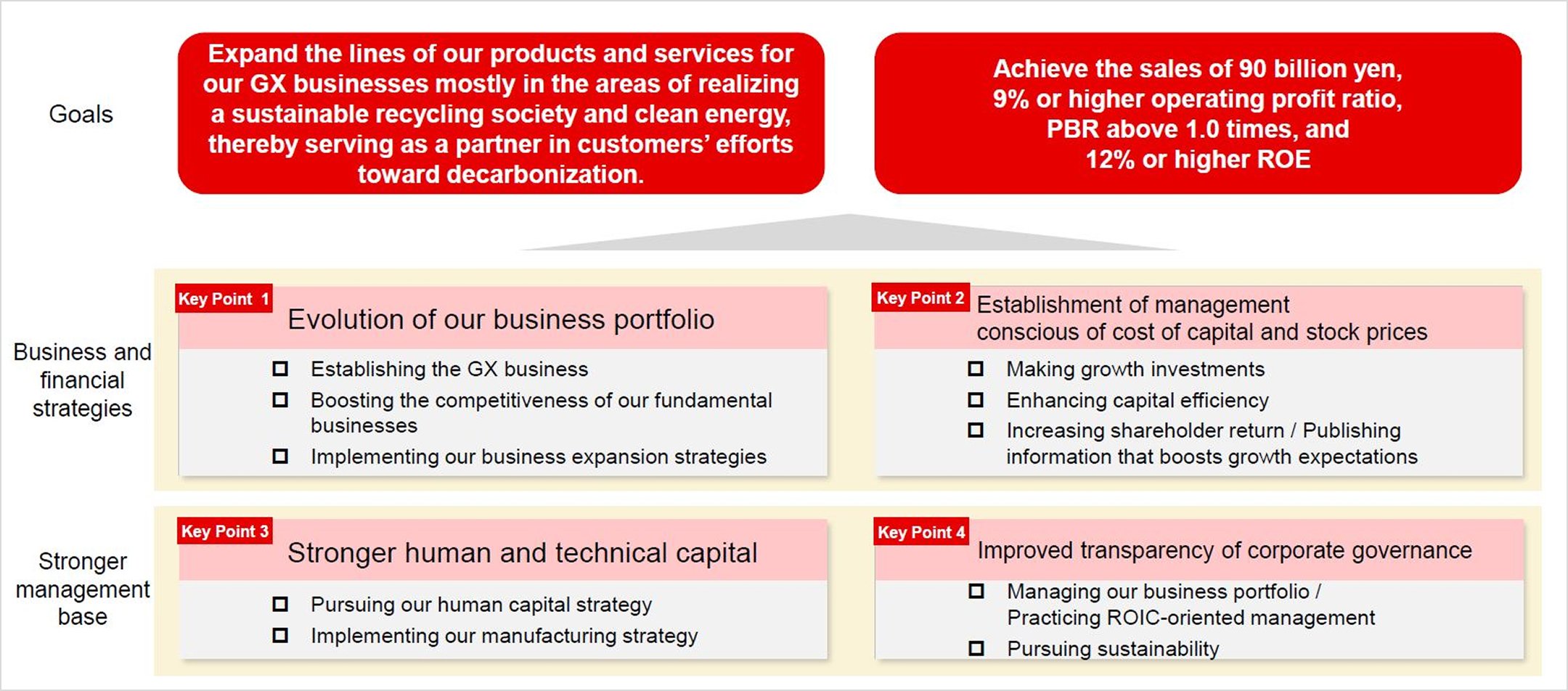

Medium-term Management Plan FY2025 - FY2027

Evolution and Transformation 2.0

We will take a leap forward over the 3 years to make our vision a reality by establishing the GX business. We will work to increase shareholder return and enhance capital efficiency while fully communicating our appeal.

Key Points and Measures in This Medium-term Plan

We will evolve our business portfolio and establish management conscious of the cost of capital and stock prices, which will be supported by a stronger and sustainable management.

Business Outline

Engineering Business

The engineering business of our corporate group has grown along with the industrial development of Japan. Our expansion into overseas markets dates back over 70 years. Since then, we have developed diverse businesses, from lifelines such as city gas, hydrogen, water, and sewage systems to chemical plants for semiconductor materials/petrochemicals and pharmaceutical production facilities. In recent years, we have been engaged in the world's first project to produce hydrogen from biogas derived from sewage and operating hydrogen stations.

Industrial Machinery Business

Our corporate group was created with the objective of domestically manufacturing machinery for the chemical industry, and the industrial machinery business is the history of our company itself. Our company has developed and manufactured many centrifuges and filtration machines using its core technologies for separation and filtration, including an oil purifier, which was developed in the 1930s and still a mainstream product. In recent years, our company has focused in the areas of nanotechnology and microfiltration, and as an "industry that supports industry," it aims to further innovate things by utilizing the technologies it has cultivated so far.