Corporate Governance

Basic policy

In order to bolster the relationship of trust with shareholders and other stakeholders, the MKK Group believes it is fundamental to ensure corporate governance in which the management structure is highly efficient and the company's business is conducted fairly and in a highly transparent manner. In addition to recognizing our social responsibility, the MKK Group is focused on promoting efficient business activities with the goal of ensuring trust in the company and ensuring proper conduct in line with our corporate philosophy and strict compliance with relevant laws and regulations.

List of governance structures

| Design of organizations | Company with an audit and supervisory committee |

|---|---|

| Executive officer system | Exist |

| Number of directors | 11 |

| Number of outside directors (independent executives) among them | 6(5) |

| Term of office of directors (excluding members of the audit and supervisory committee) | 1 year |

| Number of members of the audit and supervisory committee | 4 |

| Number of outside directors among them | 3 |

| Frequency of a meeting of the board of directors | 17 times |

| Frequency of a meeting of the audit and supervisory committee | 15 times |

| Appointment, dismissal and remuneration system for executives and others | Establishment of a nomination and remuneration committee |

April 1, 2023 to March 31, 2024

Characteristics of the corporate governance structure

We are a company with an audit and supervisory committee, the majority of which is made up of outside directors. Directors who are audit and supervisory committee members have voting rights at the board of directors' meetings and are involved in the selection of representative directors and overall decision-making regarding business operations.

- The Board of Directors meets at least once a month to decide on basic management policies, matters stipulated by laws and regulations, and other important matters related to management, and supervise the execution of operations and confirm the progress of management plans.

- In June 2016, we transitioned to a company with an audit and supervisory committee. The audit and supervisory committee consists of four directors, three of whom are outside directors . The audit and supervisory committee members are supposed to attend major internal meetings, including the board of directors' meetings, browse important documents, investigate each department and each subsidiary, and supervise the execution of business by the representative directors and other directors.

- We have adopted an executive officer system to ensure swift and appropriate decision-making and efficient organizational management.

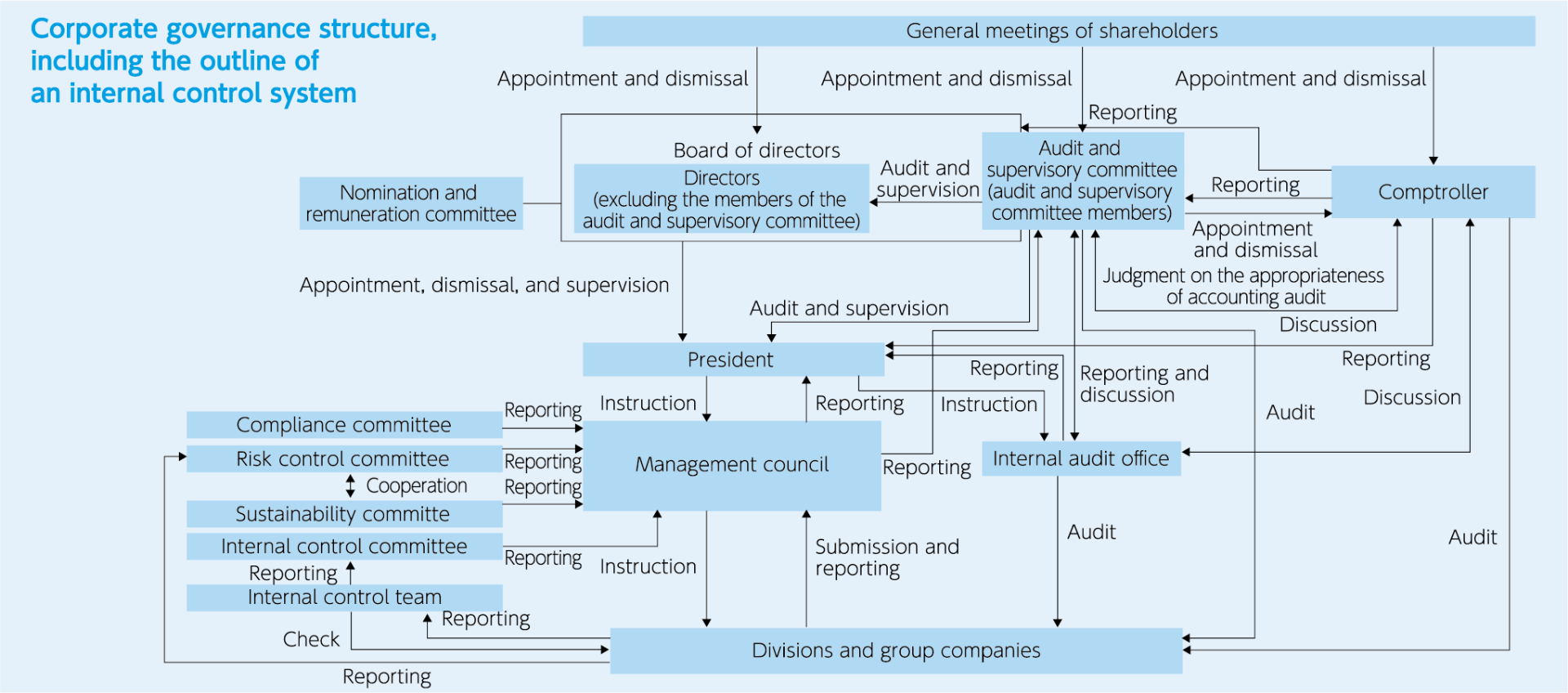

Chart showing the relation between corporate governance and internal control

Progress in the development of an internal control system

In line with its commitment to risk management and entrenched compliance, the MKK Group is broadening and strengthening the internal control system to ensure the reliability of the company's financial reporting and the proper and efficient execution of business activity at each of the divisions and subsidiaries.

The internal control committee serves as an auxiliary function to the Board of Directors (with the internal control team as a subordinate organization), while the internal audit office operates directly under the president. These organizations not only monitor the management of the internal control system for the group as a whole, but also confirm the appropriateness of individual business operations and the efficiency of checks within divisions.

This system allows appropriate corrective action to be taken whenever an internal control problem is detected.

| Board of directors |

The board of directors of our company is composed of 11 directors (including members of the audit and supervisory committee and 6 outside directors), and chaired by the director and president Toshikazu Tanaka.The board of directors is positioned as an organization that determines the basic policy for business administration, items set forth in laws and regulations, and other important items regarding business administration and oversees business execution. A meeting of the board of directors is held once or more times per month. At meetings of the board of directors, directors in charge of respective businesses report the outline of each business and share information, deliberate on individual projects, make decisions about important matters regarding business administration, and have discussions based on questions and opinions about each issue with our company from outside directors. |

|---|---|

| Audit and supervisory committee | Our audit and supervisory committee is composed of 4 directors, including 3 outside directors, and chaired by Yasuhide Hayashi. In addition, Yasuhide Hayashi and Shinichi Sakemi were appointed as full-time members of the audit and supervisory committee, in order to improve the information gathering process, make audits more effective through the sufficient cooperation with the internal audit division, etc., and strengthen the auditing and supervising functions.The audit and supervisory committee members attend major meetings in our company, browse important documents, survey divisions and subsidiaries, audit the business execution of the representative director and directors, and report audit results at a meeting of the audit and supervisory committee. A meeting of the audit and supervisory committee is held once a month. |

| Nomination and remuneration committee | In December 2019, our company established a nomination and remuneration committee as a discretionary advisory organ of the board of directors, in order to further enrich the corporate governance structure by further improving the objectivity and transparency of procedures for nominating directors and determining their remuneration amounts. This committee is composed of 3 or more directors or external experts selected through a resolution of the board of directors, a majority of members are independent outside directors, and its chairperson is appointed through a resolution of the board of directors. This committee is composed of the director and president Toshikazu Tanaka, the managing director Masahiko Saito, and the independent outside directors Masaaki Kusunoki, Mika Nakayama, Mariko Kawaguchi, Tomohiro Kikkawa, and Junko Kamei, and chaired by the independent outside director Masaaki Kusunoki. |

| Management council | Our company established a management council, which is composed of directors, executive officers, and others. This council deliberates and make decisions on the items to be discussed by the board of directors and other important matters, to streamline decision making and business operations. The management council is composed of full-time directors, executive officers, and section chiefs related to the items to be discussed, and chaired by the director and president Toshikazu Tanaka. It holds a meeting once or more times per month. |

Regarding the board of directors

The board of directors of our company is composed of 7 directors and 4 members of the audit and supervisory committee, and the balance and diversity of the entire board of directors are secured by combining the technical skills and knowledge in respective fields. In addition, the number of female directors increased from 1 in the previous fiscal year to 3, and the ratio of female directors rose to 27% (3/11).

| Post | Name | Business administration |

Finance and accounting |

Legal affairs and risk management |

Personnel / labor affairs and personnel development |

Environment, safety, and quality |

Technology, development, and information |

Experience of business related to our company |

Status of attendance at the meetings of the board of directors |

|---|---|---|---|---|---|---|---|---|---|

| Director and President | Toshikazu Tanaka | ○ | ○ | ○ | ○ | 17/17 | |||

| Managing Director | Masahiko Saito | ○ | ○ | ○ | ○ | 16/17 | |||

| Board of Directors | Kouichi Hayashi | ○ | ○ | ○ | ○ | 17/17 | |||

| Shiro Yajima | ○ | ○ | ○ | ○ | 17/17 | ||||

| Outside Directors | Masaaki Kusunoki | ○ | ○ | ○ | 17/17 | ||||

| Mika Nakayama | ○ | ○ | ○ | - / - | |||||

| Mariko Kawaguchi | ○ | ○ | ○ | - / - | |||||

| Audit and Supervisory Committee Member (Full-time) |

Yasuhide Hayashi | ○ | ○ | 12/12 | |||||

| Shinichi Sakemi | ○ | ○ | ○ | - / - | |||||

| Audit and Supervisory Committee Member (Part-time) |

Tomohiro Kikkawa | ○ | 17/17 | ||||||

| Junko Kamei | ○ | 17/17 |

*The above list indicates up to 4 fields where each one can exert his/her expertise, so there may be other fields where they can exert their expertise. In addition, Mr. Yasuhide Hayashi was appointed as a director of our company on June 29, 2023, while Ms. Mika Nakayama, Ms.Mariko Kawaguchi, and Mr. Shinichi Sakemi were appointed as a director of our company on June 27, 2024.

Evaluation on the effectiveness of the board of directors

Since FY 2016, our company has been analyzing and evaluating the effectiveness of the board of directors, and checking improvements.

For evaluation, we hold a questionnaire survey targeted at all directors, including the members of the audit and supervisory committee, regarding the composition, operation, etc. of the board of directors, and the results are reported and discussed at meetings of the board of directors.

We entrust an external consultant with the collection and summarization of answers to each questionnaire, in order to gather candid opinions and secure objective analysis.

Primary measures for improving the effectiveness of the board of directors in FY 2023

The timing of analysis and evaluation of the effectiveness of the board of directors in FY 2023 is as follows.

- Questionnaire survey during a period from March 15 to April 3, 2024

- Reporting and discussion at a meeting of the board of directors held on May 31, 2024

The items of the questionnaire for analyzing and evaluating the effectiveness of the board of directors in FY 2023 are as follows. The questionnaire items have been partially revised, while considering the results in the previous fiscal year and discussions about corporate governance last year.

- Composition and operation of the board of directors

- Management and business strategies

- Corporate ethics and risk control

- Monitoring of business performance, evaluation and remuneration of management staff

- Dialogue with shareholders and others

As a result of the evaluation, it was confirmed that the board of directors is appropriately operated, securing its effectiveness.Regarding the "items related to the management of the board of directors" among the items recognized as issues in the evaluation in the previous fiscal year, the efforts for improvement, such as the review of items to be discussed and the earlier distribution of reference material, were evaluated positively, but there were some opinions calling for further improvement. Regarding the "deliberation on management and business strategies" and "necessary information for deliberation," it was confirmed that there remain room for improvement. Furthermore, "securing of effectiveness of the whistleblowing system" and "overseeing of the succession plan" were recognized as new challenges in this fiscal year.

As a result of the evaluation, it was confirmed that the board of directors is appropriately operated, securing its effectiveness.

Compliance

Code and charter of behavior

Our company enacted "Mitsubishi Kakoki Group's Charter of Behavior" and "Mitsubishi Kakoki Group's Code of Behavior for Compliance" to follow laws and regulations, distributed them to all directors and all employees of our corporate group, including employees of affiliated companies, and holds lectures on compliance regularly to disseminate them.

In addition, we established a compliance committee, to implement measures for establishing a system for promoting the directors and employees of group companies to comply with laws and regulations, and maintaining and improving their mindsets.

Risk management

Situation of the development of the risk management structure

Our company strives to prevent risks that would affect the business of our corporate group seriously and minimize their impact. A risk management committee was established under the board of directors, to assess risks while roughly classifying the risks in our corporate group into law-related risks and business risks, discuss concrete measures, and report the progress of each measure to the management council and the board of directors.

In particular, we recognize thorough compliance with laws and regulations as the most important item, so we established a compliance committee, to implement measures for establishing a system for promoting the directors and employees of group companies to comply with laws and regulations, and maintaining and improving their mindsets.

For the management of evident risks, we established a crisis management headquarters, to take swift and appropriate measures in emergency circumstances.

Tightening of group governance

In order to realize the Mitsubishi Kakoki Group's Management Vision for 2050, we are proceeding with group management. In order to support the mutual business development and corporate value improvement of group companies, we reviewed the management structure for affiliated companies, and make efforts to streamline business operations for affiliated companies and optimize management.

In detail, we set and share internal control policies, including compliance, risk control, and crisis management, clarified our policy for involvement in group-wide business in "Regulations for managing affiliated companies," and defined business management and governance, to share information on planning, execution, follow-up, and results of business plans and corporate governance, and give necessary guidance and support.

Regarding internal control and risk management, the internal control committee and the risk management committee, which take central roles in conducting related activities, include staff from major group companies. These committees monitor the statuses of development and operation of internal control systems in the entire corporate group, the extraction and analysis of risks, and countermeasures, to improve governance further.

Executive compensation system

Basic policy

Our two basic policies regarding compensation for directors are (1) to set a compensation amount comparable to those of other companies, and (2) to provide appropriate incentives to increase corporate value over the medium/long term. Specifically, compensation for directors in charge of business execution consists of basic compensation as fixed compensation, performance-linked compensation (executive bonuses), and performance-linked stock-based compensation, while outside directors who are responsible for supervisory functions are paid only the basic compensation in consideration of their duties.

- Our policy for determining the amount of basic compensation (monetary compensation) for each individual (including the policy for determining the timing or conditions for paying compensation) Basic compensation for our directors is a monthly fixed compensation that is determined by taking into consideration market standards, our business performance, and employees' salary levels as a means to encourage the execution of duties in accordance with their position and responsibilities.

-

Policy for determining the details of performance-linked compensation and non-monetary compensation, as well as the calculation method (including the policy for determining the timing and conditions for paying compensation)

Performance-linked compensation (executive bonuses) is positioned as an incentive for achieving performance targets for each fiscal year, and the amount is determined according to the consolidated operating income forecast for the full fiscal year at the beginning of each fiscal year, the qualitative evaluation by the target management system, and the degree of achievement of the evaluation of future financial value (specific initiatives for growth in the four strategic business domains), and is paid in cash once a year. The ratio among the above indicators is as follows. Consolidated operating income : Qualitative evaluation by the target management system : Degree of achievement of the evaluation of future financial value = 70 : 20 : 10. The target performance indicators and their values are set at the time of the formulation of a plan so as to be consistent with the medium-term management plan, and are reviewed when necessary based on the report of the nomination and compensation committee in response to changes in the business environment. Non-monetary compensation is performance-linked stock-based compensation based on a system called the BIP (Board Incentive Plan) trust for executive compensation and is positioned as an incentive to support the improvement of medium/long-term corporate value and the achievement of the medium-term management plan, with the company's shares being granted after retirement in proportion to the degree of achievement of the medium-term management plan. The number of shares granted as non-monetary compensation (performance-linked stock-based compensation) varies within the range of 0-150%, depending on the achievement of the target values (consolidated operating income and ROE) of the medium-term management plan in each fiscal year, assuming the number of shares for the standard achievement of performance is 100%.

The ratio between the types of compensation is as follows: Basic compensation : Performance-linked compensation (executive bonuses) : Daily monetary compensation (performance-linked stock-based compensation) = 70:10:20. Individual compensation amounts are determined by a resolution of the Board of Directors based on the compensation policy discussed and confirmed by the compensation committee and the amounts set according to each position and responsibility.

Regarding shareholding

① Criteria and mindset for classification of investment shares and reduction policy

All shares held by our company are classified as investment shares (strategically held shares) held for purposes other than pure investment (to earn profit from changes in the value of the shares or from the receipt of dividends).

In light of the recent trend toward eliminating cross-shareholdings, we have also established a reduction policy and have been steadily reducing our cross-shareholdings since FY 2015.

② Strategically-held shares

We hold listed shares while comprehensively considering economic rationality and the necessity for business activities, such as maintaining and strengthening business relationships.

Each fiscal year, we discuss whether the benefits and risks in holding each kind of share are commensurate with the cost of capital, and then examine the appropriateness of holding the shares based on whether they are in line with the objectives of holding the shares, such as maintaining medium to long-term relationships, expanding transactions, and exerting synergies. For shares that are not deemed appropriate as a result of the examination, we will work to improve profitability and reduce holdings of shares that are difficult to improve.